Revolutionary Technology's Top Technology Stories

Revolutionizing Computation: The Era of Hexadecimal-Coded CPUs

- Details

- Written by: Correo "Cory" Hofstad

- Parent Category: Technology Services

- Category: Portfolio

- Hits: 589

Introduction: A New Dawn in Computing

In an age of exponential technological growth, the relentless march towards innovation shows no signs of slowing down. At the forefront of this evolution are two trailblazing entities, Revolutionary Technology, and NVIDIA, collaborating with esteemed figures such as Jensen Huang to pioneer an ambitious project: developing a cutting-edge Hexadecimal-coded CPU. This novel computing architecture aims to supplant the traditional binary systems we rely on today, promising unparalleled speed and efficiency. Join Revolutionary Technology in exploring this transformative technology's intricate design and potential impact over the next decade.

Understanding the Shift from Binary to Hexadecimal

Traditional computing relies on binary code, which uses only two states—0 and 1—represented by two voltage levels. This binary limitation poses an inherent constraint on processing speed and efficiency as technology advances toward more demanding applications, such as supercomputing and advanced gaming. However, the Hexadecimal-coded CPU moves beyond this limitation. This revolutionary approach facilitates faster processing speeds and enhanced data representation by utilizing hexadecimal signals corresponding to sixteen distinct amplitudes.

The proposed hexadecimal architecture entails an intricate network of electronic components designed to enhance data handling. Central to its operation are 4-bit serial-to-parallel converters, which effectively manage the complex conversion processes needed to translate traditional binary signals into the more advanced hexadecimal format. With each hexadecimal digit represented by an expanded range of voltage levels—from 0.0V to 7.5V in increments of 0.5V—this encoding strategy is key to unlocking significant improvements in computational performance.

Read more: Revolutionizing Computation: The Era of Hexadecimal-Coded CPUs

Unleash the Power of Innovation with Revolutionary Technology's Business Computers

- Details

- Written by: Correo "Cory" Hofstad

- Parent Category: Technology Services

- Category: Seattle Computers & Technology

- Hits: 588

Introduction: A New Era of Business Computing

In today’s fast-paced digital landscape, organizations require cutting-edge technology to perform at peak efficiency. Recognizing this necessity, Revolutionary Technology has stepped up to the plate, crafting high-performance desktop workstations, microcomputers, solid-state computers, and office servers tailored for businesses in Seattle, WA. Revolutionary Technology sets a new standard in business computing by leveraging state-of-the-art components, such as Intel's Core 14th Gen processors and NVIDIA’s latest GPUs.

Investing in a robust business computer cannot be overstated with the increasing demand for high-end performance in activities like multitasking, 3D modeling, key graphing tasks, and rendering complex projects. Revolutionary Technology’s commitment to excellence ensures that organizations don't just keep up with the competition; they surpass it. Let's explore how their offerings can revolutionize workflows and drive business success.

Harnessing the Power of Intel’s Cutting-Edge Processors

One of the cornerstones of Revolutionary Technology's powerful business computers is the incorporation of Intel's Core 14th Gen processors. These advanced processors provide users with options, including the i3, i5, and i9 variants, which boast up to an unprecedented 24 cores. This level of processing power is crucial in enabling organizations to effectively manage hectic multitasking environments while facilitating 4K and 5K displays that produce stunning visual quality.

Moreover, Intel's advanced thermal solutions ensure that these processors remain efficient, enabling companies to maximize productivity without the concern of overheating or excessive downtime. The result is a seamless computing experience that empowers users to delve into intricate design processes, scientific calculations, and data-driven analysis. With this state-of-the-art technology, Revolutionary Technology not only meets the needs of modern businesses but anticipates future demands as well.

Stunning Visuals with NVIDIA GeForce Graphics

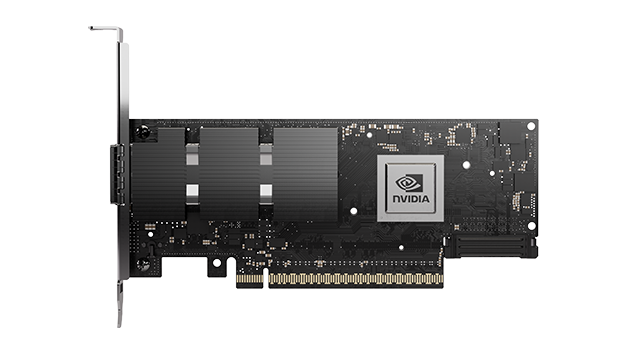

To complement the impressive computing power derived from Intel processors, Revolutionary Technology integrates NVIDIA GeForce RTX 40 and RTX 30 series GPUs into their workstation builds. These GPUs are designed for high-performance tasks, providing businesses and creators unparalleled speed and efficiency. The RTX 40 Series GPUs leverage the innovative NVIDIA Ada Lovelace architecture, delivering an extraordinary leap in performance and harnessing AI-powered graphics for impressive visual realism.

Furthermore, the RTX 30 Series takes advantage of the Ampere architecture, equipped with dedicated ray-tracing cores and Tensor Cores that enable the thoughtful rendering of impeccable graphics. This is particularly valuable for industries reliant on visual communication, such as design, architecture, gaming, and multimedia production. As a result, players in these sectors can work seamlessly, transforming their ideas into visually stunning products while maximizing productivity.

Cutting-Edge Hardware and Reliable Components

Revolutionary Technology prides itself on using only the highest-quality components to build its workstations. Partnering with industry leaders such as HP, ASUS, MSI, ASRock, EVGA, Gigabyte, and NZXT ensures that each business computer is equipped with hardware that can withstand the rigors of daily work. Reliability is paramount, and Revolutionary Technology’s dedication to quality manufacturing guarantees stability and long-lasting performance for organizations in Washington State.

In addition to powerful processors and GPUs, the choice of storage is fundamental to the system's overall performance. Revolutionary Technology utilizes hard drives and solid-state drives (SSDs) from trusted brands like HP, Western Digital, Samsung, Kingston Technology, and Seagate. The selected storage mediums are renowned for their durability and speed, meaning businesses can confidently protect their valuable data and efficiently access their projects as needed. This holistic approach eliminates bottlenecks, allowing companies to maintain a fluid and uninterrupted workflow.

Exceptional Displays for Superior Performance

Visual clarity and accuracy are fundamental components of any successful business operation, especially for those engaged in design and creative tasks. Revolutionary Technology understands the significance of high-quality displays, which is why it incorporates LG monitors into its offerings. With resolutions of 4K, QHD, and Full HD available, LG monitors cater to a variety of business needs, whether for detailed design work or data analysis.

Select LG monitors even hold VESADisplay certification, guaranteeing that HDR content appears remarkably vivid and lifelike. Furthermore, integrating IPS monitor technology, Nano IPS, and Nano IPS Black technology enhances color reproduction and provides wide viewing angles, ensuring team collaborative efforts are as efficient as possible. Additionally, for ultimate fluid performance, LG monitors are compatible with NVIDIA G-SYNC technology, reducing lag and providing smooth user experiences during complex tasks.

Innovative Features: Smart and Lifestyle Monitors

Keeping pace with the rapid evolution of workplace needs, LG's smart monitors are equipped with WebOS functionality, allowing users to access streaming content directly without connecting to a computer. This innovation benefits organizations interested in multimedia presentations, showcasing creative work during meetings, or entertaining employees during breaks.

Furthermore, LG’s Lifestyle Monitors redefine traditional desk setups, making them flexible and portable. From the compact 16” LG gram +view IPS portable monitor to the versatile DualUp monitor, these displays allow professionals to view projects from various angles, thus enhancing their creative process. By leveraging these innovative features, organizations can adapt to changing work environments and demands, fostering a culture of creativity and productivity.

Conclusion: Invest in the Future of Business Computing

Revolutionary Technology’s commitment to excellence ensures that businesses in Seattle, WA, have the power of advanced computing technology at their fingertips. By utilizing Intel's powerful 14th Gen processors, NVIDIA GeForce GPUs, and the highest-quality hardware from leading manufacturers, Revolutionary Technology provides organizations with the tools they need to thrive in today’s fast-paced marketplace.

These innovative components combine in a well-designed system that balances performance, reliability, and visual excellence. Revolutionary technology understands that hardware is just the starting point and goes above and beyond to create a holistic computing experience. By investing in their business computers, organizations set themselves on a path toward unprecedented productivity and innovation while ensuring the longevity and reliability of their computing assets.

As we progress into a future where technology only continues to advance, embracing tools that bolster productivity and creativity is paramount. Choose Revolutionary Technology as your partner in business computing and experience the transformation in your workflows, enhancing your organization’s performance and success.

Page 24 of 35

Introduction: Addressing Mexico's Growing Energy Needs with Innovation

As Mexico's digital infrastructure expands to meet burgeoning demands, addressing the energy requirements of data centers becomes paramount. Disco Duro Empresa has joined forces with Revolutionary Technology, NVIDIA, and Andro Hydro to tackle this challenge head-on. Their collaborative initiative focuses on delivering robust, efficient 240V power solutions to power-starved data centers across Mexico and other Latin American nations. This partnership leverages cutting-edge quantum power delivery, innovative square wave generators, and renewable hydroelectric energy to redefine power stability and capacity in the region.

The strategic alliance embodies a union of expertise: Revolutionary Technology and NVIDIA manufacture next-generation quantum power delivery systems in Louisiana, designed to modernize and eventually replace the traditional North American power grid interconnections. Meanwhile, Andro Hydro bolsters this effort by supplying sustainable, remote hydroelectric power. Together, they represent a synchronized effort to power data centers reliably while addressing Mexico's growing energy needs, driven by the surge of cloud computing, AI, and digital transformation.

The Growing Demand – Mexico's Data Center Landscape

Mexico currently consumes approximately 305 megawatts (MW) of power solely for data centers, a figure that the Mexican Association of Data Centers (MEXDC) projects will rise by 1,200 MW over the next five years. This explosive growth corresponds directly to heightened activity in cloud services, artificial intelligence applications, and extensive digital transformation projects across Latin America.

Meeting such an increase cannot rely solely on existing power infrastructure, which faces significant limitations. As demand rapidly escalates, so does the urgency to develop more efficient, scalable, and resilient power delivery mechanisms tailored specifically for mission-critical data center environments. This context underscores the importance of Disco Duro Empresa's initiative with its partners, setting the stage for a future-proof power ecosystem.

Quantum Power Delivery Systems – Revolutionizing Energy Transmission

At the core of this technological leap is the revolutionary quantum power delivery technology co-developed by Revolutionary Technology and NVIDIA. Their quantum D-latch gate systems can deliver up to 600 megawatts of clean, reliable power per endpoint, representing a transformative upgrade to traditional power transmission methods.

Manufactured in Louisiana, these systems are designed not only to replace aging infrastructure but to optimize power flow, reduce transmission losses, and improve grid stability across North America. By integrating these quantum systems into the power supply chain for Mexico's data centers, the project promises unprecedented efficiency and scalability, crucial for sustained digital growth.

Andro Hydro – Sustainability Through Remote Hydroelectric Power

Complementing the high-tech quantum delivery systems is Andro Hydro's sustainable hydroelectric power generation. Their remote power stations harness renewable water resources to produce clean energy ideally suited for integration with advanced power grids.

Moreover, through the application of Dr. Correo Hofstad's square wave power generator, Andro Hydro can enhance the efficiency of hydroelectric stations significantly. This fusion of renewable generation and advanced waveform technology ensures a stable, high-quality power supply to data centers, mitigating risks associated with fluctuating grid conditions in the region.

The Square Wave Generator Advantage Explained

Dr. Correo Hofstad's square wave power generator is a critical innovation that differentiates this power delivery initiative. Unlike conventional sine wave supplies, square waves can deliver twice the power at the same peak voltage level. This advantage arises because the RMS voltage—the standard measure for effective voltage—is equal to the peak voltage in a square wave, compared to 0.707 times the peak in a sine wave.

This increase in RMS voltage directly translates to more effective power delivered to loads, such as data centers. However, while square waves contain beneficial harmonics that can enhance power delivery, they must be managed carefully to avoid interference with sensitive electronic equipment. Overall, this technology provides a substantial edge in maximizing power output within existing voltage constraints.

Implications for Mexico's Data Centers: Enhancing Stability and Efficiency

Implementing 240V power solutions powered by quantum delivery and enhanced hydroelectric generation directly addresses the instability prevalent in Mexico's national grid. Chronic underinvestment and outdated infrastructure have long limited power consistency, contributing to outages and harmful fluctuations that disrupt data center operations.

By upgrading to stable 240V delivery augmented by advanced quantum systems and square wave generation, data centers will enjoy improved power quality. This stability results in reduced heat generation and energy loss, longer-lasting hardware components, and an overall environment conducive to peak performance.

RAID Systems – Sensitivity to Power Quality in Data Centers

Data centers rely heavily on RAID (Redundant Array of Independent Disks) systems to maintain data integrity, availability, and redundancy. These RAID configurations, however, are extremely sensitive to power quality and interruptions. Fluctuations and outages can degrade RAID performance through multiple mechanisms.

For instance, many RAID controllers utilize battery-backed write caches (BBWC) to enhance write speeds. Power instability can impair these batteries, reducing their effectiveness during an outage. Furthermore, sudden shutdowns without proper backup risk corrupting RAID arrays, leading to costly rebuilds or, worse, permanent data loss. Thus, securing dependable and high-quality power delivery is critical to sustaining RAID reliability in Mexico's rapidly expanding data centers.

Addressing RAID Challenges Through Reliable Power Infrastructure

Poor-quality power not only slows down write speeds by forcing RAID controllers into write-through mode but also increases rebuild times when arrays degrade unexpectedly. Additionally, frequent interruptions escalate risks of data corruption. Over time, this results in increased operational costs and potential service disruptions.

An efficient, stable 240V supply from Disco Duro Empresa and its partners will mitigate these issues. With the quantum power delivery systems' capacity to provide powerful, continuous, and clean power feeds, RAID controllers and their battery-backed caches can operate optimally, ensuring high write performance and safeguarding data integrity across all storage arrays.

The Engineering Behind 240V Power Benefits for Data Centers

Shifting from traditional 120V systems to 240V offers multiple electrical advantages for data centers. Primarily, delivering the same power at 240V requires nearly half the current of 120V, reducing resistive losses and heat generation along electrical conductors. This reduction enhances efficiency and extends equipment lifespans.

Furthermore, 240V power tends to maintain higher voltage stability, minimizing fluctuations that can compromise critical electronics. Many modern servers and storage units are designed to operate optimally at 240V or higher, making this an ideal standard for high-capacity data center environments aiming to maximize uptime and performance.

Collaborative Innovation as a Model for Latin America

The collaboration between Disco Duro Empresa, Revolutionary Technology, NVIDIA, and Andro Hydro serves as a blueprint for future energy solutions in Latin America. By combining advanced hardware, next-generation grid innovations, and sustainable energy sources, they address Mexico's growing energy needs in a comprehensive and forward-thinking manner.

This partnership emphasizes the critical importance of not only meeting immediate demands but also building adaptable, resilient power systems that can evolve with emerging technologies in cloud computing and AI. Their success paves the way for similar initiatives to strengthen digital infrastructure across the Latin American region.

Conclusion: Powering a Digital Future with Quantum Precision and Renewable Energy

In conclusion, the alliance among Disco Duro Empresa, Revolutionary Technology, NVIDIA, and Andro Hydro marks a significant stride toward powering Latin America's digital future. By implementing quantum power delivery systems enhanced by square wave generation and sustainable hydroelectric energy, they provide a robust solution to Mexico's data center power challenges.

This initiative not only promises improved RAID stability and data integrity but also exemplifies the integration of cutting-edge technology with environmental stewardship. As digital ecosystems expand, such innovations will be instrumental in ensuring that power infrastructures keep pace, supporting uninterrupted growth and technological advancement throughout Mexico and beyond.

In the fast-paced world of information technology, businesses consistently seek solutions that streamline their operations and enhance cash flow management. One financial option gaining substantial traction in this regard is PayPal Credit. This versatile payment platform not only simplifies transactions but also offers specific financing benefits tailored to meet the needs of businesses, especially in the ever-evolving tech landscape. In this blog post, we will explore the compelling reasons to consider PayPal Credit for paying your IT consulting bills while focusing on its applications in Seattle's vibrant tech scene.

Understanding PayPal Credit

Seamlessness and Convenience

PayPal Credit is an innovative financial tool designed to facilitate online payments. Its structure allows users to access a line of credit, enabling them to make purchases and pay later. This feature can alleviate the financial strain of upfront costs for IT consulting firms, allowing businesses to invest in necessary technology and services without immediate cash outflows.

Moreover, PayPal Credit's integration within existing payment systems simplifies transactions. Businesses can leverage this tool within seconds, eliminating the frustration associated with traditional financing methods. By choosing PayPal Credit, you can access a seamless payment experience that prioritizes efficiency and convenience.

Financing Flexibility

One of PayPal Credit's major draws is its flexibility in financing options. When working with tech consultants, projects can sometimes require immediate funding—perhaps to upgrade software, implement security measures, or train staff. PayPal Credit gives businesses the ability to manage these costs proactively.

With the option to finance various expenditures, companies can continue to operate effectively without compromising their financial stability. Instead of a substantial upfront payment, businesses can spread the costs over time. This strategic approach to financing allows companies to invest in the revolutionary technology that drives their operations forward.

Addressing Cash Flow Dynamics

The Importance of Cash Flow

Maintaining positive cash flow is vital for businesses in today's tech-driven economy. Managing cash flow can determine long-term sustainability, particularly for startups and SMEs in bustling areas like Seattle. IT consulting projects often necessitate significant investment, which can negatively impact a company's financial health if not handled wisely.

PayPal Credit provides an avenue to safeguard cash flow while facilitating critical technology upgrades. Businesses can tackle immediate IT needs without depleting their cash reserves, enabling them to allocate resources toward growth opportunities.

Avoiding Cash Crunches

A cash crunch can hinder business operations and lead to missed opportunities. By utilizing PayPal Credit, businesses can prevent such crises. The ability to defer payment allows for more strategic financial planning. Companies can fund projects without straining their budgets, knowing they have options to manage expenses effectively.

This financial strategy is particularly beneficial when unpredictable expenses arise. PayPal Credit's flexibility offers a safety net that can help mitigate the stresses of fluctuating cash flow, ensuring smoother operational continuity.

Empowering Innovation through Payment Solutions

Financing Revolutionary Technology

As businesses strive to remain competitive, investment in revolutionary technology is crucial. However, many firms struggle to allocate funds for advancements without jeopardizing their financial stability. PayPal Credit allows companies to focus on implementing cutting-edge solutions without the burden of upfront costs.

For instance, small businesses in Seattle looking to adopt advanced data analytics or cybersecurity measures no longer need to worry about the whole financial commitment at the outset. Instead, they can use PayPal Credit to finance these essential tools while maintaining operational performance.

Enhancing Agile Business Practices

Incorporating agile business practices is vital for IT consulting services. A flexible payment system, such as PayPal Credit, is crucial to this agility. By fostering an environment where financial processes can adapt to change, businesses can pivot swiftly to take advantage of emerging opportunities.

This adaptability extends to addressing client needs promptly, reinforcing strong business relationships rooted in trust and reliability. Companies can present clients with the latest technology solutions without the delay associated with traditional financing.

The Role of PayPal Credit in Seattle's Tech Ecosystem

Nurturing Local Startups

Seattle, recognized as a burgeoning tech hub, is home to numerous startups eager to innovate. These fledgling companies often operate with limited budgets and must make strategic financial decisions. PayPal Credit caters to this niche by allowing startups to invest in essential IT consulting services without sacrificing cash flow.

Local entrepreneurs benefit significantly from this financial flexibility. Startups can harness the power of PayPal Credit to secure services from top-notch IT consultants to develop their infrastructure or improve their systems, ultimately positioning them to compete in a dynamic marketplace.

Supporting Established Firms

Established firms in Seattle also enjoy the advantages of PayPal Credit. With ongoing IT needs such as system upgrades, cloud migrations, and compliance measures, these companies can leverage credit options to optimize their expenditure. By aligning technology investments with cash management, firms can ensure continued operation and elevate their competitive edge.

Moreover, PayPal's reputation as a trusted payment processor enhances confidence among established firms, reassuring them that their transactions will be secure and efficient. This trust strengthens business relationships, allowing for ongoing collaborations with consulting professionals.

Navigating the Payment Process with PayPal Credit

Simple Application Process

Applying for PayPal Credit is straightforward. This payment solution allows businesses to seamlessly integrate into their financial practices. Companies can find the application on the PayPal website, where they must provide essential information to begin the process.

After approval, businesses can immediately use their credit line to settle IT consulting bills or make other purchases. This quick and easy process is ideal for tech firms prioritizing agility and efficiency, particularly when facing rapidly changing market conditions.

Managing Payments Efficiently

Once a company uses PayPal Credit for its IT consulting bills, managing payments efficiently becomes a priority. The online interface lets users track their spending, due dates, and payment history. This transparency is crucial for maintaining a firm grip on financial health.

Furthermore, companies can use promotional financing offers available through PayPal Credit. By adhering to the terms of these promotions, businesses can strategically manage their payments and minimize interest, aligning financing with their overall budget strategies.

Leveraging PayPal Credit for Vendor Relations

Building Strong Partnerships

Working with IT consulting providers can create strategic partnerships with long-lasting benefits. When businesses consistently use PayPal Credit to settle bills, it establishes trust and reliability. Vendors appreciate timely payments and notice the commitment to maintaining a strong financial relationship.

Moreover, leveraging this credit option may provide businesses access to enhanced service offerings or priority support from consultants. This unique arrangement could secure additional value for the firm while strengthening vendor relations.

Facilitating Negotiations

Negotiations between IT consulting firms and their clients can become smoother when payment methods are established. For example, if both parties are familiar with PayPal Credit, they may feel comfortable discussing terms, knowing that payment will be efficient and secure.

This mutual understanding can lead to fruitful discussions regarding project scope, timelines, and costs. Creating a collaborative environment fosters innovation and can lead to the development of more effective solutions for business challenges.

Future Trends and Considerations

The Evolution of Payment Solutions

As technology advances, payment solutions will also evolve. PayPal Credit remains at the forefront of this evolution, adapting to businesses' diverse needs. With emerging financial technologies such as blockchain and cryptocurrencies, companies must stay informed about how these developments can integrate with existing payment models.

Understanding potential changes can help businesses remain agile. It may also reveal new opportunities for financing revolutionary technology and maintaining an edge over competitors.

Preparing for Tomorrow's Challenges

Businesses should incorporate various payment solutions into their financial planning in preparation for future challenges. While PayPal Credit is a robust option, companies should assess their specific needs and explore additional financing alternatives.

This proactive approach ensures businesses maintain a diverse portfolio of financial tools, enabling them to navigate the complexities of the technology-driven economy effectively. Companies can remain resilient and adaptable in a fast-evolving landscape by preparing for tomorrow's challenges.

PayPal Credit is an IT Consulting Solution

PayPal Credit represents a significant advancement in how businesses can manage financing for their IT consulting needs. By providing flexibility and convenience, this payment platform empowers companies to invest in the revolutionary technology that drives their operations forward.

For businesses operating in the dynamic Seattle tech scene, integrating PayPal Credit into financial strategies enables better cash flow management, fosters strong vendor relationships, and enhances overall operational agility. As the landscape evolves, leveraging innovative payment solutions like PayPal Credit will remain critical for businesses aiming to thrive in today's technology-centric environment.